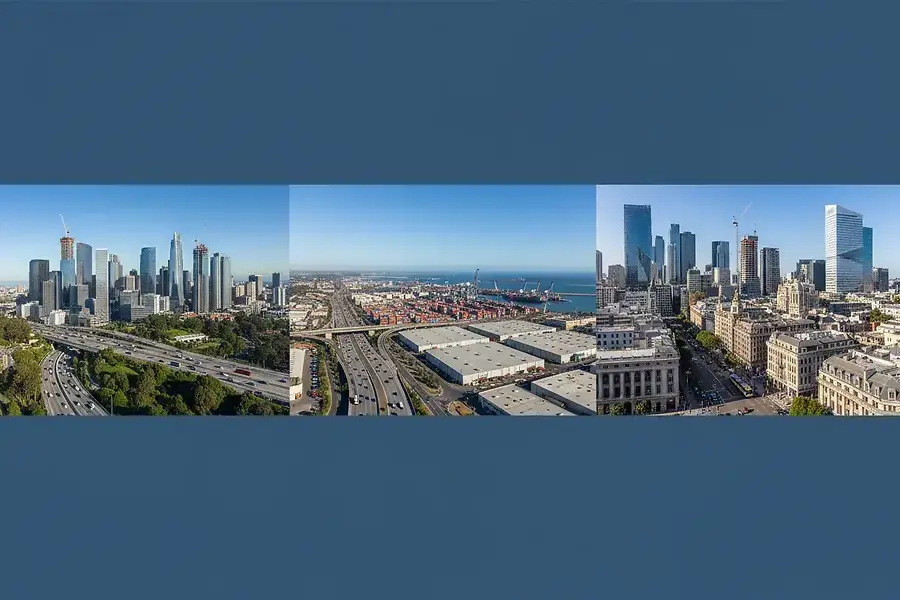

Commercial Real Estate Opportunities in Bay Area, San Diego, and Europe

Discover high-potential commercial properties and investment strategies across three dynamic markets.

Introduction: Why Commercial Real Estate Spans Multiple Markets

Commercial real estate investment has evolved into a sophisticated, global endeavor. Savvy investors recognize that diversifying across multiple markets—whether in the United States or internationally—provides stability, growth potential, and protection against localized economic downturns. The Bay Area, San Diego, and Europe each offer distinct advantages, from technology-driven growth to industrial expansion and long-term value appreciation. Understanding these markets enables investors to make informed decisions and build resilient portfolios.

Bay Area Commercial Market: Tech-Driven Growth and Office Trends

The Tech Influence on Commercial Real Estate

The Bay Area remains a global epicenter for technology and innovation, directly influencing its commercial real estate landscape. Major tech companies continue to expand their footprints, creating demand for office spaces, research facilities, and mixed-use developments. However, the market has evolved significantly, with companies increasingly adopting hybrid work models.

Office Space Evolution

Traditional office spaces are transforming into collaborative hubs designed for innovation and employee engagement. Properties featuring modern amenities, flexible layouts, and sustainability certifications command premium prices. Investors should focus on:

- Class A office buildings in prime locations with strong tenant bases

- Mixed-use developments combining retail, residential, and office spaces

- Data centers and tech facilities supporting cloud computing and AI infrastructure

San Diego Commercial Properties: Retail and Industrial Expansion

Retail Market Dynamics

San Diego's retail sector is experiencing a renaissance, driven by population growth and consumer spending. The market shows resilience with e-commerce integration, experiential retail, and entertainment-focused properties gaining traction. Prime locations near major transportation hubs and residential areas offer excellent investment potential.

Industrial and Logistics Boom

The industrial sector in San Diego is thriving, fueled by proximity to international ports and major distribution networks. Warehousing, fulfillment centers, and light manufacturing facilities are in high demand. Key opportunities include:

- Last-mile delivery centers supporting e-commerce growth

- Cold storage facilities for food and pharmaceutical distribution

- Flex industrial spaces adaptable to various business needs

European Commercial Investments: Diversification and Long-Term Value

Market Stability and Growth Potential

European commercial real estate offers investors stability, mature markets, and long-term appreciation potential. Cities like London, Berlin, Paris, and Amsterdam present diverse opportunities across office, retail, and industrial sectors. European properties typically feature:

- Strong regulatory frameworks protecting investor interests

- Established tenant bases with long-term lease agreements

- Currency diversification benefits for international portfolios

Emerging Opportunities in Secondary Markets

While major European cities remain attractive, secondary markets in Eastern Europe and Southern Europe offer higher growth potential with moderate risk. These markets benefit from EU integration, infrastructure development, and increasing foreign investment. Properties in cities like Prague, Warsaw, and Lisbon present compelling value propositions for growth-oriented investors.

Comparing Markets: Risk Assessment and ROI Potential

Bay Area: High Growth, Higher Risk

The Bay Area offers substantial ROI potential, particularly in tech-focused properties. However, market volatility, high acquisition costs, and competitive bidding can increase risk. Expected returns typically range from 6-10% annually, with significant appreciation potential in prime locations.

San Diego: Balanced Growth and Stability

San Diego presents a more balanced risk-return profile. The industrial sector shows consistent demand, while retail offers moderate growth. Expected returns range from 5-8% annually, with lower volatility compared to the Bay Area. The market's diversification across sectors provides natural hedging.

Europe: Conservative Returns, Long-Term Security

European investments typically deliver conservative but stable returns of 3-6% annually. The trade-off is reduced volatility and strong capital preservation. European properties serve as portfolio anchors, providing steady income and long-term appreciation without the intensity of U.S. market fluctuations.

Risk Comparison Framework

Market Risk Profile: Bay Area (High Growth/High Risk) → San Diego (Moderate Growth/Moderate Risk) → Europe (Conservative Growth/Low Risk)

Conclusion: Positioning Your Portfolio Across Global Commercial Markets

A sophisticated commercial real estate strategy incorporates opportunities across multiple markets, balancing growth potential with risk management. The Bay Area provides explosive growth opportunities for aggressive investors, San Diego offers balanced returns with industrial strength, and Europe delivers stability and long-term value.

Strategic positioning involves:

- Allocating capital based on risk tolerance and investment timeline

- Diversifying across property types and geographic regions

- Monitoring market trends and economic indicators in each region

- Partnering with local experts and experienced property managers

- Maintaining flexibility to capitalize on emerging opportunities

By understanding the unique characteristics of each market and aligning investments with your financial goals, you can build a resilient commercial real estate portfolio that thrives across economic cycles and geographic boundaries. The future of commercial real estate belongs to investors who think globally and act strategically.