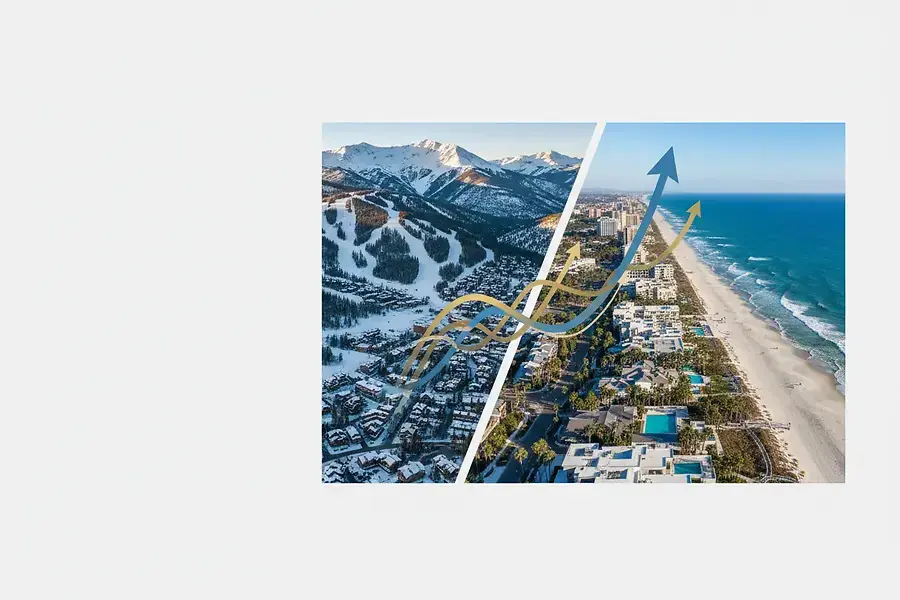

Dual Market Opportunities: Investing Across Mountain and Coastal Properties

Discover how savvy investors are building diverse portfolios by leveraging the unique advantages of Colorado's mountain markets and South Carolina's coastal real estate landscape.

Introduction: Why Diversification Matters in Real Estate Investment

Real estate investment has long been considered one of the most reliable paths to building wealth. However, concentrating all your capital in a single market can expose you to unnecessary risk. Diversification across different geographic markets and property types is the cornerstone of a resilient investment portfolio. By spreading investments across distinct regions with different economic drivers, you can weather market fluctuations and capitalize on growth opportunities wherever they emerge.

Two markets that have captured the attention of sophisticated investors are Colorado's mountain regions and South Carolina's coastal areas. Each offers compelling advantages that, when combined strategically, create a powerful investment framework for long-term wealth accumulation.

Mountain Markets vs. Coastal Markets: Understanding the Investment Profiles

Colorado's Mountain Markets: The Growth Engine

Colorado's mountain communities have experienced remarkable growth over the past decade. Several factors drive this expansion:

- Population Migration: Young professionals and families are relocating to mountain towns seeking lifestyle improvements, outdoor recreation, and remote work flexibility.

- Tourism and Hospitality: Year-round attractions—skiing in winter, hiking and biking in summer—create consistent demand for vacation rentals and hospitality properties.

- Economic Diversification: Beyond tourism, mountain communities are developing tech hubs, creative industries, and service sectors.

- Limited Supply: Geographic constraints mean limited new development, supporting property appreciation and rental demand.

Investment Profile: Mountain properties typically offer higher rental yields from vacation rentals, strong appreciation potential, and appeal to both primary residence buyers and investors. The market rewards those who understand seasonal demand patterns and can manage short-term rental operations effectively.

South Carolina's Coastal Markets: The Stability Play

South Carolina's coastal regions present a different but equally compelling investment thesis:

- Affordability Advantage: Compared to other coastal markets, South Carolina offers exceptional value, attracting both owner-occupants and investors.

- Retirement Destination: Retirees seeking warm climates and lower costs of living are driving steady residential demand.

- Commercial Growth: Port development, logistics, and manufacturing create commercial real estate opportunities.

- Stable Appreciation: Coastal properties benefit from consistent demand and limited developable land.

Investment Profile: Coastal properties excel as long-term holds with steady appreciation, reliable rental income from residential tenants, and lower volatility. The market attracts conservative investors seeking predictable returns and strong fundamentals.

Comparative Analysis

The ideal portfolio balances the growth potential of mountain markets with the stability of coastal markets, creating a hedge against regional economic cycles.

Mountain markets offer higher growth potential and rental yields, while coastal markets provide stability and consistent appreciation. Together, they create a balanced approach to real estate wealth building.

Residential, Commercial, and Mixed-Use Opportunities Across Both Regions

Residential Properties

Mountain Residential: Single-family homes and condominiums in mountain communities appeal to vacation buyers, second-home owners, and primary residence seekers. Properties with rental licenses can generate substantial income during peak seasons. The key is understanding local regulations around short-term rentals and seasonal demand patterns.

Coastal Residential: Beachfront and near-beach properties attract retirees, families, and investors seeking long-term rental income. Multi-family properties and apartment complexes offer economies of scale and consistent cash flow. Coastal residential markets reward patient investors who hold for appreciation.

Commercial Properties

Mountain Commercial: Retail spaces, restaurants, and hospitality properties thrive in mountain towns. The seasonal nature of mountain tourism creates opportunities for investors who can manage variable occupancy rates. Commercial properties often command premium rents during peak seasons.

Coastal Commercial: Office spaces, retail centers, and industrial properties benefit from regional economic growth. South Carolina's expanding business environment creates demand for modern commercial real estate. These properties typically offer longer lease terms and more stable tenants than mountain commercial properties.

Mixed-Use Developments

Both regions present opportunities for mixed-use developments that combine residential, commercial, and hospitality components. Mixed-use properties maximize land value and create vibrant communities that attract diverse tenant bases and support higher valuations.

In mountain areas, mixed-use developments integrate lodging with retail and dining. In coastal regions, mixed-use projects combine residential units with ground-floor retail and office space, creating walkable communities that appeal to modern residents.

Strategic Considerations for Each Property Type

- Due Diligence: Understand local zoning, rental regulations, and market cycles before investing.

- Management: Mountain vacation rentals require active management; coastal long-term rentals offer more passive income.

- Financing: Lenders may have different requirements for vacation rental properties versus traditional rentals.

- Tax Implications: Consult with tax professionals about depreciation, passive income rules, and state-specific considerations.

Conclusion: Building Your Multi-Market Real Estate Strategy

Building a successful real estate portfolio across mountain and coastal markets requires strategic planning and market knowledge. The most successful investors recognize that different markets serve different purposes within a diversified portfolio.

Start by assessing your investment goals, risk tolerance, and available capital. Consider allocating a portion of your portfolio to Colorado's mountain markets for growth and higher yields, while establishing a foundation in South Carolina's coastal properties for stability and consistent appreciation.

Key steps to implement your strategy:

- Research local market conditions, rental rates, and appreciation trends in your target areas.

- Network with local real estate professionals, property managers, and other investors.

- Understand the regulatory environment, including rental restrictions and tax implications.

- Start with one or two properties while you build expertise and market knowledge.

- Scale gradually as you develop systems for property management and tenant relations.

The dual-market approach isn't just about geographic diversification—it's about building a resilient investment strategy that captures growth opportunities while maintaining stability. By thoughtfully combining mountain and coastal properties, you position yourself to build lasting wealth across multiple economic cycles and market conditions.