Park City Real Estate Market: Investment Opportunities Across All Property Types

Discover how Park City's diverse real estate landscape offers profitable opportunities for investors seeking commercial, residential, or mixed-use properties.

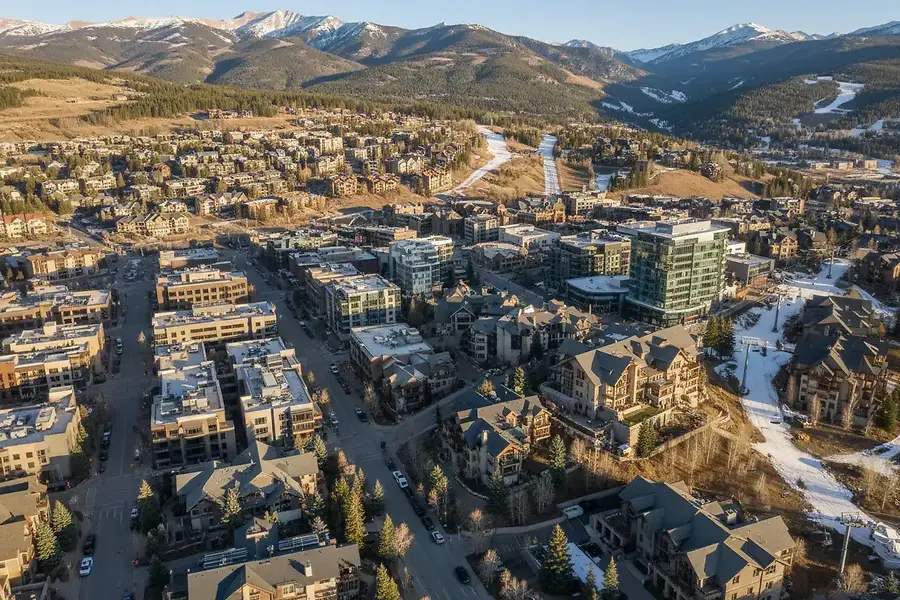

Understanding Park City's Diverse Real Estate Market

Park City has emerged as one of the most dynamic real estate markets in the region, attracting investors from around the world. The market's strength lies in its diverse portfolio of property types, each offering unique advantages and growth potential. Whether you're a seasoned investor or exploring opportunities for the first time, understanding the nuances of Park City's real estate landscape is essential for making informed decisions.

The city's appeal stems from several key factors: its thriving tourism industry, world-class skiing infrastructure, growing residential demand, and strategic location. These elements combine to create a robust investment environment where multiple property types can thrive simultaneously. The market has demonstrated resilience and consistent growth, making it an attractive destination for capital deployment.

Market Fundamentals and Growth Drivers

Park City's real estate market is driven by several powerful forces that continue to shape investment opportunities:

- Tourism and Hospitality Demand: Year-round visitors create consistent demand for accommodations and hospitality services

- Population Growth: Increasing residential migration to the area supports housing demand across all price points

- Economic Diversification: Beyond skiing, the city has developed a robust economy with tech, entertainment, and service sectors

- Limited Land Availability: Constrained supply of developable land supports property value appreciation

- Infrastructure Development: Ongoing improvements to transportation and utilities enhance property accessibility

Commercial Properties: Growth Potential and ROI Strategies

Commercial real estate in Park City represents one of the most compelling investment opportunities available today. The sector encompasses retail spaces, office buildings, hospitality properties, and service-oriented businesses that cater to both residents and visitors.

Retail and Service Sector Opportunities

Retail properties in Park City benefit from consistent foot traffic driven by tourism and local spending. Prime locations in downtown areas and near ski resorts command premium rents and attract quality tenants. Investors can expect solid returns through:

- Long-term lease agreements with established brands

- Seasonal demand fluctuations that create premium pricing opportunities

- Value-add opportunities through property improvements and tenant mix optimization

- Strong appreciation potential in high-traffic corridors

Hospitality and Lodging Investments

The hospitality sector remains a cornerstone of Park City's commercial real estate market. Hotels, vacation rentals, and short-term lodging properties generate substantial cash flow while benefiting from the city's tourism appeal. Key considerations for hospitality investments include:

Strategic positioning near ski resorts and entertainment venues significantly impacts occupancy rates and nightly rates, directly influencing overall return on investment.

Investors should evaluate property management quality, seasonal demand patterns, and competitive positioning when assessing hospitality opportunities. The market has shown strong recovery and growth, with properties in premium locations achieving impressive occupancy rates and revenue per available room metrics.

Residential and Mixed-Use Development: Maximizing Value

Residential real estate in Park City ranges from luxury single-family homes to multi-unit apartment complexes, each serving different investor objectives and market segments.

Single-Family and Luxury Residential

High-end residential properties in Park City attract affluent buyers seeking vacation homes, primary residences, and investment properties. This segment offers:

- Strong appreciation potential in established neighborhoods

- Rental income opportunities through short-term vacation rentals

- Buyer diversity including international purchasers

- Premium pricing supported by lifestyle amenities and location

Investors in this segment should focus on properties with distinctive features, excellent locations, and strong rental potential. The luxury market has demonstrated resilience and continues to attract capital seeking stable, appreciating assets.

Multi-Unit and Apartment Developments

Multi-family residential properties provide consistent cash flow and portfolio diversification. Park City's growing population supports demand for rental apartments across various price points. Development opportunities exist for:

- Workforce housing to support service industry employees

- Mid-range apartments targeting young professionals and families

- Premium apartment communities with resort-style amenities

- Senior living communities serving the aging population

Mixed-Use Development Potential

Mixed-use properties combining residential, retail, and hospitality components represent some of the most valuable development opportunities in Park City. These properties maximize land utilization and create synergistic revenue streams. Benefits include:

- Multiple income sources from different property types

- Enhanced property values through integrated development

- Reduced vacancy risk through diversified tenant base

- Increased appeal to institutional investors and capital sources

Making Your Investment Decision in Park City's Dynamic Market

Successful real estate investment in Park City requires careful analysis, strategic planning, and a clear understanding of your investment objectives.

Key Due Diligence Factors

Before committing capital, investors should thoroughly evaluate:

- Market Fundamentals: Supply and demand dynamics, absorption rates, and price trends

- Property Condition: Physical inspections, environmental assessments, and deferred maintenance analysis

- Financial Performance: Historical cash flows, operating expenses, and income projections

- Regulatory Environment: Zoning restrictions, development regulations, and local policies

- Tenant Quality: Creditworthiness, lease terms, and renewal probability

Risk Management and Portfolio Strategy

Diversification across property types and geographic locations within Park City helps mitigate risk. Consider your investment timeline, capital requirements, and exit strategies when building your portfolio. Professional guidance from real estate advisors, attorneys, and financial consultants can significantly enhance decision-making quality.

Capitalizing on Current Market Conditions

Park City's real estate market continues to present compelling opportunities for investors willing to conduct thorough research and execute strategic acquisitions. The combination of strong fundamentals, diverse property types, and consistent demand creates an environment where well-positioned investments can generate substantial returns.

Whether you're interested in commercial properties generating steady cash flow, residential developments offering appreciation potential, or mixed-use projects combining multiple revenue streams, Park City's market has opportunities suited to various investment profiles and objectives.

The key to success lies in understanding your investment goals, conducting comprehensive due diligence, and positioning your capital in properties and locations with the strongest fundamentals and growth potential. Park City's dynamic real estate market rewards informed, strategic investors who take the time to understand market dynamics and identify opportunities aligned with their investment criteria.